Major Shift #3: The American Political Cycle

Our next 50 year cycle is coming due around 2030 — what will that mean for us?

Post Summary:

The US is at the tail end of the 5th political cycle in our history and will transition to the 6th in a few years

Key Theme: Economic inequality is driving the shift into the next cycle

Financial Implications: Taxes will likely increase in the next decade or so

“Remember…that everything has always been the same, and keeps recurring, and it makes no difference whether you see the same things recur in a hundred years or two hundred, or in an infinite period.” - Marcus Aurelius, Meditations.

Ugh. Politics. It’s invaded our lives over the past decade and it doesn’t look like it will let up any time soon. But something feels different this time. Is it?

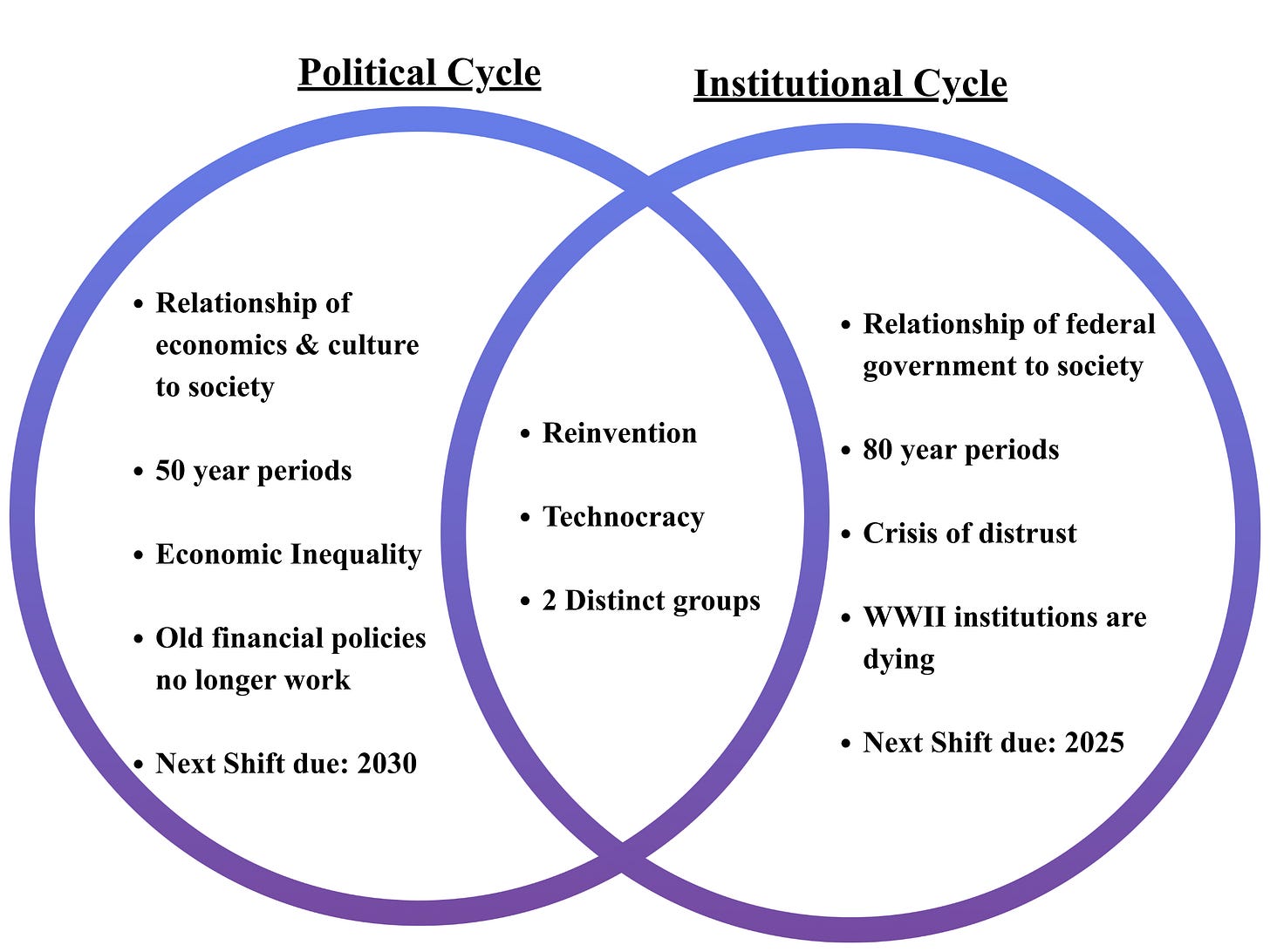

Between now and the next few posts, we are going to touch on key historical cycles, how they work, and how they could affect us. The next two in particular are intertwined, but more on the institutional cycle in the next post:

Cycles seem to mysteriously reflect our natures. Our political cycle invokes an American personality, of a new people in a new world, in a hurry to get somewhere. This may explain, compared to the other cycles, its historical brevity (about fifty years). It thumps like a heartbeat driving us forward.

The cycle isn’t just a changing of the guard from one political party to another, but something much more fundamental — a major shift in economic priorities. Social unrest pops up every few decades like the tip of an iceberg. Lurking beneath are the deeper issues of money and culture.

The cycle typically goes like so: an old policy hurts most of the country financially, political tensions arc, the pendulum swings, and the next election ushers in a new political majority (new President, Congress, etc). Laws are passed and the underlying problem is addressed. The policies works for decades until later into the cycle, when they lose potency. Fifty-ish years in, the entire process repeats.

In total, America has repeated this cycle five times. We are due for our sixth around 2030. If the pattern holds, the 2028 or 2032 presidential election will likely be the beginning of the next cycle. Forces seem to point to 2028 as the crucial year, and if so, that election would determine the next fifty years, politically and financially.1

The Current Cycle

Every cycle is a reaction to the one before it. At the beginning of our cycle, Ronald Reagan was responding to FDR in the 1930s. FDR was trying to solve the 25% unemployment rate and get the economy moving again during the great depression. Laws were passed to focus on workers, and following WWII, they forged the middle-class.

Economic policies work initially at the beginning of a cycle, but later on lose momentum. At some point, FDR’s policies stopped working. Factories built during WWII became outdated and desperately needed investments to update and revamp; however, taxes were so high it just wasn’t worth it for the investment class. The top income tax rates soared to 94% during the WWII, and were still around 70% by Reagan’s inauguration. If the after-tax returns are negligible, why risk your money for so little?

Reagan and a new Congress passed laws to drop the tax rates down to 38% and encourage investments into the economy. The flood gates opened: investors poured into US businesses, spurring an economic boom in the late 80’s and 90’s and leading to the proliferation of the microchip, the computer, and the internet. Investors empowered companies like Apple, Microsoft, and Amazon to invent the modern age.

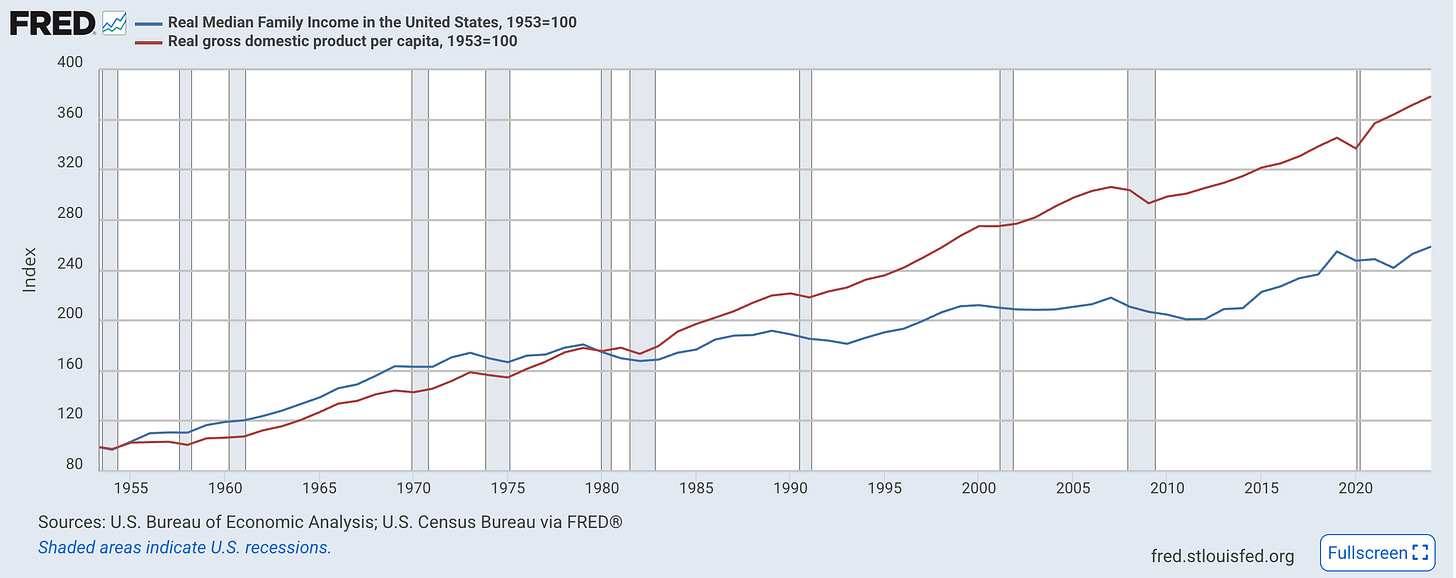

But as in all cycles, what solves a financial problem eventually becomes its own problem. Before the current cycle, most corporate profits flowed to employees. After 1980 with Reagan, the revenue started flowing to shareholders. Here’s a chart from the Federal Reserve showing that as the economy grew, less and less revenue went to household income from 1980 onward.

Middle-class incomes stopped growing like they did in previous cycles. While Reagan’s policies were needed to revamp business infrastructure, over time they led to the hollowing out of the middle-class. What went unnoticed initially becomes painfully obvious decades later on as inflation reveals all — the middle-class collapsed. In many instances, they’re now the “working poor.”

But not everyone suffered. Beneficiaries of investments in tech, the middlemen of investors in finance, and the wealthy themselves saw disproportionate returns. Look at this old chart below from the Economic Policy Institute comparing wage growth of top earners vs the bottom 90%:

This is how the current political and the institutional cycle are intertwined: they are not just happening simultaneously but a particular group overlaps both cycles leading to a declining middle-class and a rising upperclass. We will hash this dynamic out more in the next post.

Key Theme: Economic Inequality

The current system no longer works for most Americans. Polling is confirming it’s reaching a fever pitch: The top issue in the 2024 presidential race was inflation, and the #1 issue in the recent NYC mayoral election was the cost of living. The right, left, and center are all repeating the same theme from their own viewpoints. “America first” on the right is essentially the same as “healthcare for all” on the left — that we should prioritize the middle-class first and above all else. When all sides are saying the same thing, it’s only a matter of time before a tsunami crashes into the political world and launches the next cycle.

Interestingly, the last president at a cycle’s end is often clueless to the forces underway. As financial problems arise, the last president uses the same old playbook, the policies that once worked at the beginning, but now decades later cease to work. Trump is repeating the pattern of Reagan. His new tax legislation sends more money to the wealthy at a time when the system is oversaturated with investment funds. Ponder how long we had 2-3% interest rates for mortgages and ask if that makes any sense. Hint: the overabundance of funds in the system drove the cost of borrowing to nearly free…that’s not normal. There’s just too much in investments within the system and too little flowing to the middle-class.

Next Cycle

If the cycle repeats, the emphasis on investors will shift back to the middle-class. It just has to because the financial lives of a growing majority is untenable. Any old policy that stops upward mobility will become public enemy number one.

A few points are crucial to keep in mind. First, after each new cycle, prosperity has always followed. Addressing the underlying economic issues tends to propel us forward even if politics favors one group for a season. Second, in each cycle, policies were often “radical” until accepted (both FDR and Reagan are clear examples). Solutions could feel uncharacteristic.

Third, the run-up to the 2028 presidential election (or as late as 2032) could get even uglier in our political life, just as in past cycles. Right up to Reagan, we has assassinations (MLK & RFK), soldiers shooting protesters (Kent State), and a presidential coverup (Nixon). Sound familiar? History tends to rhyme as we repeat the chorus, again and again, every fifty-ish years. The 2020s aren’t unique. Chaos is a feature, not a bug, of the American political cycle.

Last: prepare for unfathomable coalitions. “Reagan Democrats” put a Republican in the White house in 1980, kicking off today’s cycle. It’s entirely possible the economic inequality of Southern Whites and African Americans overlaps to such a degree that they join forces, creating a new voting bloc. When a far right Congressman is praised for their economic views by a self-described socialist, the old definitions of “right” and “left” are officially in flux. Prepare for strange bedfellows as we head into 2028.

Financial Implications: Taxes will likely go up

When the pendulum swings from the wealthy to the middle-class, the tax code will likely be overhauled to help workers over shareholders. I would expect higher taxes for top earners in a decade or so, unless a “billionaire” tax passes. The line in the sand seems to be about $400k of household income and up. If you’re near that, you must make tax planning an annual necessity.

Daylight is Coming

The 2020s have been intense, and they could still get worse…but the good news is that we can see the finish line. A shift is underway. Our climate proves that. Every fifty-ish years we feel like the Republic won’t make it. And yet, we persist. It doesn’t break us, but sets up the launch into the next period. It isn’t pretty, but it’s how the American political cycle works. Hang on. Something good comes our way…eventually…

All come to look for America…

Disclaimer: Jordan Spencer and Vox Financial Planning LLC’s website and social media pages are limited to the dissemination of general information pertaining to its investment advisory services. Content contained on or made available through Vox Financial Planning LLC’s website or social media pages is not intended to and does not constitute legal, tax or investment advice, and no advisory relationship is formed. A professional adviser should be consulted before acting upon any of the information presented. Any tax and estate planning information provided is general in nature and should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation.

Read George Friedman’s work if you’d like to go deeper on this topic.